Nov 01, 2018 A private key can be use to sign a document and the public key is use to verify that the signature of the document is valid. The API we use to generate the key pairs is in the java.security package. That’s mean we have to import this package into our code. The class for generating the key pairs is KeyPairGenerator. Generate private key for signature java. In this example you will generate a public/private key pair for the Digital Signature Algorithm (DSA). You will generate keys with a 1024-bit length. Generating a key pair requires several steps: Create a Key Pair Generator. The first step is to get a key-pair generator object for generating keys for the DSA signature. Generating a Digital Signature shows using the API to generate keys and a digital signature for data using the private key and to export the public key and the signature to files. The application gets the data file name from the command line.

People and institutions who contributed to their success, according to the Key Private Bank Advisor Poll on philanthropy. The United States is on the precipice of one of the largest generational wealth transfers in history, with $68 trillion in assets expected to be transferred to heirs and charities by 2030, according to Cerulli Associates. Apr 10, 2020 It’s human nature for us to be concerned about the future wellbeing of our loved ones. We want them to succeed, even after we’re gone. But what is generational wealth really, and how do you use it to leave a legacy? What is Generational Wealth?

- Generational Wealth Is The Key Lyrics

- Generational Wealth That's The Key

- Generational Wealth Is The Key Of Florida

- Developing Generational Wealth

- Creating Generational Wealth

- Generational Wealth Solutions

Save Gold, Earn Income $$$ and Invest.

Leave A Financial Legacy For Generations to Come.

Save Gold, Silver, and Invest In Energy Resources.

Leave A Financial Legacy For Generations to Come.

Karatbars VIsitors

Save Gold

“Gold is money. Despite what policymakers and economist would have you believe. Gold will remain as a store of wealth par excellence and continue to play an integral role in the world’s monetary system. Gold is still poised in the reserves of the International Monetary System and will be even more important in the years to come.” ~ Jim Rickards ~ New Case For Gold.

Fiat Currency

In 1971, President Richard Nixon, took the U.S., off the Gold Standard, Declaring The Dollar Fiat. which means: to decree it to be so. Therefore, the only value it has is the faith man puts in it. ‘Quantitative Easing’ of the dollar, is the cause of inflation and the results are a general increase in prices and fall in the purchasing value of the dollar.

Cryptocurrencies

Cryptocurrencies are the blockchain applications and include digital peer to peer payment systems, crowd sales, facilitation, implementation pf predictions markets and generic tools for governance. Bitcoin, Litecoin, Ripple, *Dash, Zcash, Monero, Ethereum Etc.

BlockChain Technology

A Blockchain is a peer to peer systems with no central authority managing data flow with a large distributed network of independent users. These “full nodes” computers are located in more than one specific location. Each Blockchain is made up of blocks, which each holds a valid transaction. Each of the blocks will include a hash of the block before it and this is what links the two together. When transacting business on the blockchain they are placed on a public exchange, very transparent and yet cannot be hacked.

Decentralization

Decentralization cuts out the risk of data being hacked because the network does not have centralized points that are vulnerable as in centralized networks. Encryption Technology is based on private and public keys. The public key is a long string of numbers generated randomly and this is the blockchain address of the user. The transaction that goes across the network is recorded on that key. The private key is like a password and is what allows the owner access to their digital assets. If you store data on the blockchain it cannot be corrupted but you will need to take extra measures. Create a paper wallet and print your private key to safeguarding it by placing it in a safe place.

Affiliate Business Package Pricing

There has never been a better time to position yourself in this dynamic investment opportunity; to build real wealth with real assets. The hedge around your income earning potential is of course, No-Risk. The bigger the package; the bigger the commission.

This is Why It Is Very Important For You And Your Family To Seriously Begin Looking For Alternative Ways To Protect Your Finances & This is Where We Come In. We Offer Various Ways To Ensure, Grow And Protect Your Hard Earned Money For Generations To Come.

Money Done Right does not run display ads or accept sponsorships to promote particular products or services. However, we may receive a commission if you purchase or sign up through links on this page. Here's more information about how we make money.

“Generational wealth” is a term that’s thrown around quite frequently these days.

But what is the definition of generational wealth?

And how you can create generational wealth and build it for you and for your family?

Well, let’s start with the easy part: defining generational wealth.

What Is Generational Wealth?

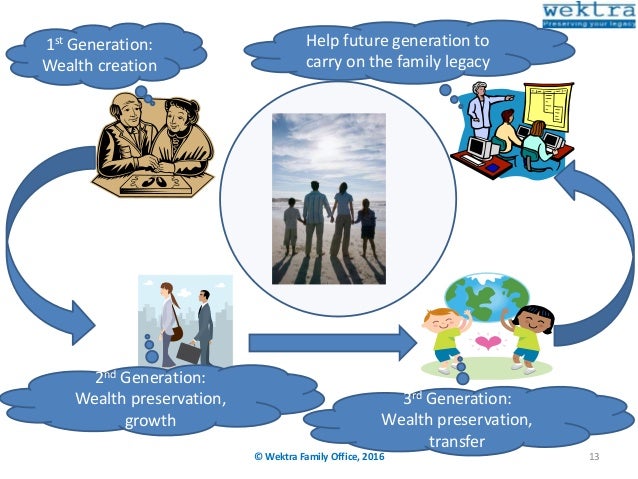

Generational wealth — also called family wealth or multigenerational wealth or legacy wealth — is wealth that is passed down from one generation to another.

Now, generational wealth takes many forms.

It can be in the form of traditions and heirlooms, or even biology and good genes.

But typically, when people talk about generational wealth, they’re talking about financial wealth that can be passed down to the next generation.

How Can I Build Generational Wealth?

You build generational wealth by acquiring generational assets that you can leave to your heirs.

Assets are anything you own that makes money for you rather than take money out of your pocket.

For example, my dividend-paying stocks are generational assets.

Every few months, I get money deposited into my account because I own these assets.

Removes the php artisan key:generate command which can be problematic when running the container with a console attached. Laravel generate key without artisan bar. Laravel 4: key not being generated with artisan. I can see the generated key in my shell, but the variable 'key' in app.php remains empty. Running on localhost with windows-apache-php 5.4 - mysql. Never had this problem before with laravel 4 beta version.

And when I pass away, I can leave these stocks to the next generation, and they will collect dividends as well.

3 Ways Anyone Can Build Generational Wealth With $25-$500

Obviously the richest of the rich leave assets like hotels and businesses to the next generation.

But, thankfully, there are ways that the rest of us can start building generational wealth today with as little as $25.

Check out these 3 ways that anyone can build generational wealth today.

1. Invest in dividend-paying stocks.

We love dividends here at Money Done Right.

When you invest in a dividend-paying stock, you are acquiring a portion of a company that somebody else built and that thousands of other people work for, and they are giving you a portion of their profits. Blows my mind!

There are plenty of great places to open up a stock-investing account, but the one that’s getting us hot and bothered at the moment is Ally Invest.

Ally Invest is great because you can trade dividend stocks for as little as $3.95 per trade compared to $6.95 at E*TRADE and Charles Schwab.

Ally Invest has developed a pretty amazing platform, and no matter if the stock market goes up or done, we still get dividends deposited into our Ally Invest account every quarter!

2. Invest in real estate with as little as $500.

In the old days, you needed a lot of money to invest in real estate.

Generational Wealth Is The Key Lyrics

$500 would not have cut it.

But thanks to advances in technology, real estate investing has become democratized.

Now, if you have $500 or $1,000 in your pocket, you can get started investing in real estate through a platform called Fundrise.

Generational Wealth That's The Key

Fundrise is the first private market real estate investing platform.

By combining technology with new federal regulations, Fundrise lets you invest in the once-unattainable world of private investments.

3. Lend out money at 4-6% interest. ($25 Minimum)

Lending out money is one of the oldest ways to earn passive income. It’s essentially renting out your money for either people to use, and the rent you charge is known as the interest rate.

Generational Wealth Is The Key Of Florida

Now, in the old days, if you wanted to lend money to somebody in particular, you were taking on a pretty risky business, unless he or she put up some form of collateral.

But now, thanks to technology, you can spread out the risk by only lending your money in $25 increments.

How does this work? Well, let’s say Borrower A needs a $25,000 loan.

Instead of going to one entity, like a bank or rich person, to borrow the full $25,000 — which would be very risky to that one entity — he or she borrows $25 from 1,000 people.

This scenario presents much less risk because the most any single investor could lose is only $25.

Developing Generational Wealth

Such an arrangement would have been administratively impossible just 15 years ago.

Creating Generational Wealth

But thanks to the wonders of the Internet, it is now very possible, and the peer-to-peer lending industry, as it’s known, is thriving for borrowers and investors alike.

Nia Simone McLeodGenerational Wealth Solutions

Nia Simone McLeod is a personal finance researcher and writer for Money Done Right. After receiving a bachelor’s degree in journalism from Virginia Commonwealth University, she started her writing career by going freelance and producing content for clients on a variety of different topics including personal finance. When she’s not tapping away at her laptop, she’s either curating her next great Spotify playlist or stuffing her face at the local ramen shop. Nia currently resides in Richmond, Virginia.